6.1 Accounts pertaining to the five accounting elements.

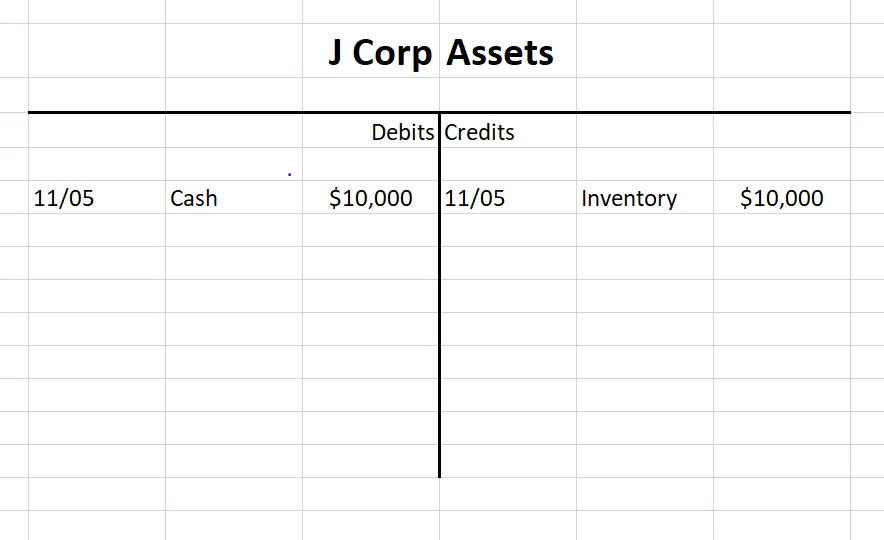

5.1 Attributes of accounting elements per real, personal, and nominal accounts.Debit balances are normal for asset and expense accounts, and credit balances are normal for liability, equity and revenue accounts. For a particular account, one of these will be the normal balance type and will be reported as a positive number, while a negative balance will indicate an abnormal situation, as when a bank account is overdrawn. When the total of debits in an account exceeds the total of credits, the account is said to have a net debit balance equal to the difference when the opposite is true, it has a net credit balance. Despite the use of a minus sign, debits and credits do not correspond directly to positive and negative numbers. Alternately, they can be listed in one column, indicating debits with the suffix "Dr" or writing them plain, and indicating credits with the suffix "Cr" or a minus sign. Similarly, the landlord would enter a credit in the rent income account associated with the tenant and a debit for the bank account where the cheque is deposited.ĭebits and credits are traditionally distinguished by writing the transfer amounts in separate columns of an account book. For example, a tenant who writes a rent cheque to a landlord would enter a credit for the bank account on which the cheque is drawn, and a debit in a rent expense account. Each transaction transfers value from credited accounts to debited accounts. A debit entry in an account represents a transfer of value to that account, and a credit entry represents a transfer from the account.

Debits and credits in double-entry bookkeeping are entries made in account ledgers to record changes in value resulting from business transactions.

0 kommentar(er)

0 kommentar(er)